Executive summary

Many investors see themselves as passive investors. Passive investors care about costs and comfort. A fixed-weight mix of equities and bonds is usually a solid investment strategy. But it does not excel in booms or crashes. Even though they are long-term investors, passive investors should pay attention to the market cycle and listen carefully to the Shiller PE. It improves the return, but more importantly for passive investors it reduces portfolio risk.

Passive investing brings ease and comfort

Many investors are passive investors. The popularity of passive investing has grown exponentially. According to the European Central Bank, the share of passive equity investments has surpassed 50% since the first passive fund was launched in 1993. The share of passive bond investors is lagging but is catching up fast. Passive investing has grown rapidly, mainly because it is cheap and easy.

There are two things to unpack here. First, passive investors use index funds[1] to track the return of an index. So, you earn the index return, minus minimal fees. Research from Morningstar reports an average fee of 1.12% for actively managed funds, while passive funds charge 0.19%. Other research shows portfolio managers struggle to outperform the index to justify the difference in cost. Investors get better returns with an index fund.

Second, passive investors divide their assets over sectors, currencies and most importantly asset classes. This mix protects portfolios against unexpected events. The so-called 60/40-portfolio is often used. 60% of your wealth is invested in equities and 40% is invested in bonds. Equities offer high returns but have elevated risk. An allocation to bonds balances the equity risk. The combination offers good returns on average.

Good on average and that is the problem

However, this doesn’t guarantee consistently good returns. Recently, long-term investors in the 60/40 portfolio have faced two periods of negative returns. While this portfolio delivers steady returns on average, it never excels in either booms or crashes. The portfolio lost money in 2020 and 2022. Portfolio performance minus inflation, 2022 was as bad as it was in 2008. Investors with an equity/bond portfolio lost 15% in real terms. This impacts the comfort that passive investors are seeking.

A static portfolio is like dressing up with shorts and an anorak. The shorts are good for Summertime and the anorak protects you from the cold. On average, you have the right clothing. But you have never a perfect match and you look funny.

Two reasons make it important to deal with it. First, emotionally. Market crashes cause distress. Second, financially. The best returns usually happen after stock market crashes. If you never anticipate stock market crashes, you will never benefit from the recovery phase, which is the phase with the best returns for investors. This justifies more flexibility. A dynamic diversified portfolio lowers drawdowns.

Market cycle is relevant for all investors

Even long-term passive investors should pay attention to the market cycle. Professional investors use valuation to determine the market cycle. Valuation attaches a value to something. When you compare it with its price, you get a valuation indicator. A valuation indicator tells you how much bang you get for your buck. In the grocery store, a six-pack is a better deal than six separate soda cans.

Investment analysts do the same. The price/earnings ratio tells how much investors are willing to pay for each dollar of a company’s earnings. The higher it gets, the less attractive your deal is. Do this for all stocks in an index and it gives you the valuation of the stock market. That valuation fluctuates. In good times, optimistic investors are willing to pay a higher valuation for stocks. But in recessions, the price/earnings ratio falls due to moody investor sentiment. A price/earnings ratio below 12 is considered cheap, while one above 24 is viewed as expensive. Active investors incorporate valuations, trying to achieve outperformance.

Long-term investors can use valuation to their advantage. A special variety, the Shiller price/earnings ratio (Shiller PE), is more useful than the regular version. The Shiller PE factors in the economic cycle to assess market valuation.

By taking the average earnings of the past 10 years, the Shiller PE smooths the economic cycle. It makes the valuation less sensitive to the current state of the economy, either very optimistic or very pessimistic.

Shiller price/earnings ratio: low or high?

The ratio fluctuates between cheap and expensive for US stock market

Origins from 1930

Robert Shiller, a professor at Yale, conducted interesting research in 1987. He found a reliable inverse relationship between the level of the price/earnings-ratio and future returns. The more you pay, the less you get. Later, he published a book “Irrational exuberance.” about the insanely high valuation of the stock markets. It was published at the top of the US stock market in 2000. He coined the indicator Shiller PE.

Caution if you care for the cycle

Other researchers confirmed the relation of the Shiller PE with future returns. The caveat is that it works best in the long term. Passive investors are long-term investors. While useful, this indicator is not an exact science. Instead of giving clear buy or sell signals, it offers a more nuanced view of market conditions. Price/earnings-ratios contrast objective facts (price) versus subjective opinion (at what level the PE ratio is high?). The stock price is a fact, but when do we consider the market to be cheap or expensive? Is it cheap at 8-, 14- or 16-times earnings? Well, it depends on the environment. Inflation may be a factor: the stock market may be cheap because inflation is high. Or the other way around. The indicator is most effective at extremes. A very high valuation may lead to the conclusion to slowly trim your equity exposure (at high valuation). It is much more difficult to draw similar conclusions when valuations are close to average.

Buy low valuations, sell high valuations

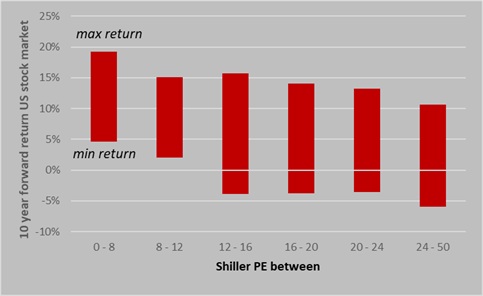

Both minimum and maximum forward returns decrease when Shiller PE increases

There are good reasons to think we have entered a new era with AI, robots, and biotech. The Shiller PE is higher than ever. Investors are full of confidence and willing to pay higher valuations. But economic laws remain the same. So, while passive investing is great, don’t forget to check whether the market is overpriced or undervalued using tools like the Shiller PE. By incorporating the Shiller PE into your passive investing strategy, you can avoid the worst market extremes and better position your portfolio to thrive in the long term.

Are you interested to learn more about asset allocation or the Shiller PE?

Contact me by sending a message.

Leave a Reply